𝗟𝗢𝗢𝗞𝗜𝗡𝗚 𝗥𝗜𝗖𝗛 𝗜𝗦 𝗘𝗔𝗦𝗬. 𝗕𝗘𝗜𝗡𝗚 𝗥𝗜𝗖𝗛 𝗜𝗦 𝗥𝗔𝗥𝗘.

- Kaushik Sarkar

- 4 days ago

- 2 min read

Your 𝘮𝘰𝘯𝘦𝘺 should buy you 𝘧𝘳𝘦𝘦𝘥𝘰𝘮, not just a lifestyle.

The real question: 𝗔𝗿𝗲 𝘆𝗼𝘂 𝗯𝘂𝗶𝗹𝗱𝗶𝗻𝗴 𝘄𝗲𝗮𝗹𝘁𝗵… 𝗼𝗿 𝗷𝘂𝘀𝘁 𝘁𝗵𝗲 𝗶𝗹𝗹𝘂𝘀𝗶𝗼𝗻 𝗼𝗳 𝗶𝘁?

Over the years, I have met 𝘤𝘰𝘶𝘯𝘵𝘭𝘦𝘴𝘴 high-earning professionals, business owners, and “successful” people.

On paper — and on Instagram — they looked rich.

But when I gently asked about their 𝗹𝗶𝗾𝘂𝗶𝗱 𝗽𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼 — the kind of real, accessible wealth that could sustain their lifestyle even if their active income stopped tomorrow, most smiled awkwardly… and admitted they didn’t really have that kind of cushion.

Some admitted there’s always something new to tempt them, and their savings quietly disappear into it.

Most of them already understand the value of liquid assets, so they often respond, “But I’ve started investing in SIPs recently.”

While that’s a great first step, it’s often like planting a seed today and expecting shade tomorrow — it still takes time, discipline, and consistent nurturing before it turns into meaningful financial security.

I don’t share this to judge—it’s a reminder for all of us, including myself, that 𝗼𝘄𝗻𝗶𝗻𝗴 𝗮𝘀𝘀𝗲𝘁𝘀 𝗶𝘀𝗻’𝘁 𝘁𝗵𝗲 𝘀𝗮𝗺𝗲 𝗮𝘀 𝗵𝗮𝘃𝗶𝗻𝗴 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗳𝗿𝗲𝗲𝗱𝗼𝗺.

A luxury car, a big house, or the latest phone might feel like progress… but without steady cash flow and reserves, it is a fragile kind of success.

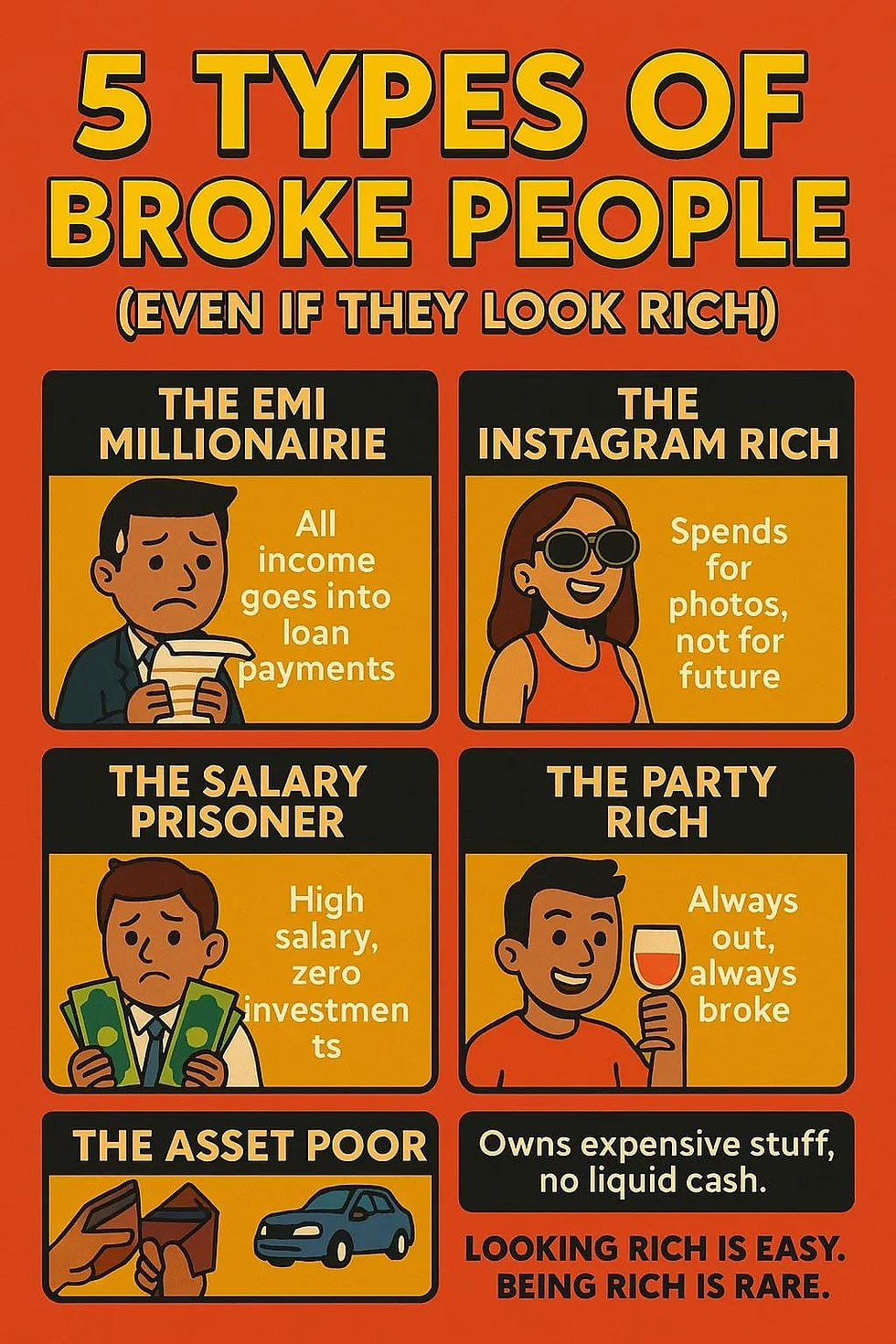

𝟱 𝗰𝗼𝗺𝗺𝗼𝗻 𝘁𝗿𝗮𝗽𝘀 𝗜 𝗵𝗮𝘃𝗲 𝗻𝗼𝘁𝗶𝗰𝗲𝗱:

1️⃣ 𝗧𝗵𝗲 𝗘𝗠𝗜 𝗠𝗶𝗹𝗹𝗶𝗼𝗻𝗮𝗶𝗿𝗲

They seem to “own” everything — house, car, gadgets — but in reality, the bank owns it.

Every month, most of their income is already committed to EMIs, leaving little for actual savings or investments.

2️⃣ 𝗧𝗵𝗲 𝗜𝗻𝘀𝘁𝗮𝗴𝗿𝗮𝗺 𝗥𝗶𝗰𝗵

They look amazing online — perfect vacations, fine dining, luxury shopping.

But much of it is funded by swiping cards, not building a future. They get likes today but have no plan for tomorrow.

3️⃣ 𝗧𝗵𝗲 𝗦𝗮𝗹𝗮𝗿𝘆 𝗣𝗿𝗶𝘀𝗼𝗻𝗲𝗿

They earn a big paycheck, but their lifestyle grows with it.

No investments, no passive income — so if the salary stops, their life comes to a halt too.

4️⃣ 𝗧𝗵𝗲 𝗣𝗮𝗿𝘁𝘆 𝗥𝗶𝗰𝗵

Always at the latest club, event, or getaway.

They live for experiences (which is fine), but they forget that memories don’t pay bills, and end up broke in between paydays.

5️⃣ 𝗧𝗵𝗲 𝗔𝘀𝘀𝗲𝘁 𝗣𝗼𝗼𝗿

They own expensive assets — big houses, luxury cars, branded watches.

But when an emergency strikes, they don’t have enough liquid cash to handle it without selling something.

Real wealth isn’t the house, the car, or the watch — it’s the 𝗳𝗿𝗲𝗲𝗱𝗼𝗺 𝘁𝗼 𝗰𝗵𝗼𝗼𝘀𝗲 𝘆𝗼𝘂𝗿 𝘁𝗶𝗺𝗲, 𝘆𝗼𝘂𝗿 𝘄𝗼𝗿𝗸, 𝗮𝗻𝗱 𝘆𝗼𝘂𝗿 𝗹𝗶𝗳𝗲 without fear of the next bill.

📌𝗚𝗲𝗻𝘁𝗹𝗲 𝗿𝗲𝗺𝗶𝗻𝗱𝗲𝗿: Build liquid, income-generating assets. They won’t look flashy, but they will quietly change your life.

Next time you meet someone who seems to be “doing well,” ask yourself — are they truly free, or are they just funded?

Comentarios